- 15 Sep 2023

- ICICIdirect

YATRA ONLINE LIMITED IPO OPENS FOR SUBSCRIPTION ON 15TH SEPTEMBER

The last IPO for the week is Yatra Online Limited (YOL), a familiar name for most of you. Earlier in the week, we saw R R Kabel, SAMHI Hotels, and Zaggler IPO opening for subscription. Two of them are still open, you may check the details before applying for them. In this article, we will discuss Yatra IPO in detail, which opens for subscription on 15th September and closes on 20th September. The various aspects related to the company will help you decide whether to subscribe or invest in the IPO for the long term.

Yatra Online Limited IPO: Key Details

Below are the key details related to the YOL IPO:

- Issue Size: Rs 775 crore

- Price Band: Rs 132 - Rs 142

- Issue Details: Rs 602 crore Fresh Issue + Offer for Sale of 12,183,099 Equity Shares

- Market Cap: At the upper price band, Rs 2,228 crore

- Minimum Investment: Rs 14,910

Yatra Online Limited: Understanding the business

Yatra is India’s largest corporate travel services provider in terms of several corporate clients and the third-largest online travel company in India among key OTA players in terms of gross booking revenue and operating revenue, for FY23. As of 31 March 2023, Yatra has the largest number of hotel and accommodation tie-ups amongst key domestic OTA players of over 2,105,600. YOL provides access through their platform to hotels, homestays, and other accommodations, with about 1,05,600 hotels in 1,490 cities and towns in India, as of FY23 and more than 2 million hotels globally, which is the highest hotel inventory amongst key Indian OTA players.

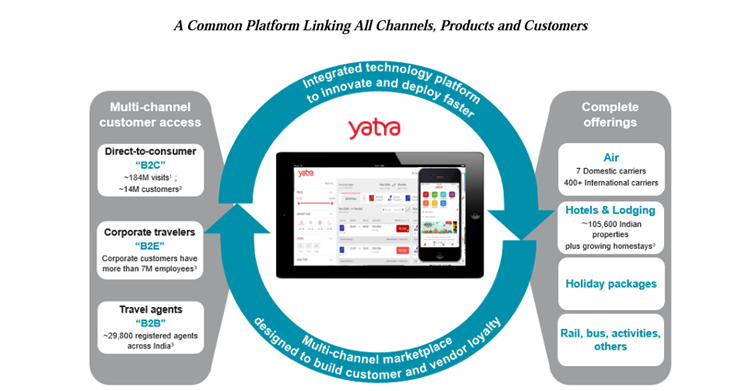

The company's business is based on a common technology platform that serves its customers through multiple mobile applications and its website www.yatra.com. Leveraging its brand and technology platform, the company plans to continue to expand and enhance its offerings through innovative travel solutions that will grow its business, improve customer experience, and meet the changing needs of business and leisure travelers.

Yatra Online, Inc., a Cayman Islands limited company with shares listed in the USA on the NASDAQ Capital Market under the symbol “YTRA”, is the holding company of THCL and Asia Consolidated DMC Pte. Ltd.

Yatra Online Limited IPO: Industry Outlook

Most of us would have some idea of the industry. However, let us talk about the numbers. The Indian travel industry is expected to clock a 9-11% CAGR between FY23 and FY28. The growth will be led by the development of tourism infrastructure, rising income levels translating to higher discretionary spending on travel and tourism, an increase in the frequency of travel business and leisure purposes, reforms in visas, and an increase in connectivity across means of transport.

It is estimated that air ticketing has a high online penetration of 74-76% as of FY23, as this segment was the first to adopt online channels, followed by railways (80-82%). The commencement of e-ticketing services by IRCTC in 2002 has helped the online railways ticketing segment gain ground. CRISIL MI&A expects online penetration in airline and rail ticketing to improve to 80-82% and 81-83%, respectively, by FY28, on account of the sheer convenience offered by online channels. The Indian online ticketing market is to log an 11-13% CAGR between FY23 and FY28.

Yatra Online Limited IPO: Listed Peers

The company has many players in the segment both domestically and internationally. However, comparison with global OTA players will not be relevant. In the listed space locally, it has only one peer - Easy Trip Planners Ltd. Let us compare the two companies:

- In terms of revenue (FY23), Easy Trip Planners is the larger player, with a revenue of Rs 464.20, while Yatra has a revenue of Rs 397.47 crore.

- The earnings per Share (EPS) is higher for Easy Trip Planners, but only slightly.

- Return on Net Worth (RoNW) is much higher for Easy Trip Planners at 36.21% compared to Yatra's 4.50%.

Yatra Online Limited IPO: Financials

Let us now look at the most important part that one needs to consider while evaluating a new company - the company's financials. Below are the financial numbers of Yatra over the last three financial years:

- The company has reported a revenue of Rs 125.45 crore, Rs 198.07 crore, and Rs 380.16 crore for FY21, FY22, and FY23, respectively. Revenue has more than tripled in this period. However, for FY21, the travel industry was significantly down because of the pandemic.

- Yatra has reported an EBITDA of Rs (5.06) crore, Rs 32.15 crore, and Rs 66.97 crore for FY21, FY22, and FY23, respectively. In the same period, the EBITDA margins were (4.04)%, 16.23%, and 17.62%, respectively. The margins have increased gradually post-pandemic.

- For the corporate travel business, they have served over 800 large corporate customers where their customer retention rate concerning corporate accounts has improved from 97% in FY21 to 98% in FY22 and remains consistent in FY23 i.e., 98%.

- For FY23, Air ticketing had a margin of 7.69%, while Hotels and Packages had a margin of 13.06%. The margins have fallen from 11.44% (Air Ticketing). and 19.71% (Hotels and Packages) for FY21.

- YOL has served over 14 million cumulative travel customers as of March 31, 2023, with over half of them having signed up for their eCash loyalty program.

- Except for FY23, the company has reported losses in the two financial years. For FY21 and FY22, the loss reported by the company was Rs (118.86) crore and Rs (30.79) crore, respectively. For FY23, the net profits reported were Rs 7.63.

- For the last three financial years, Yatra has reported an average EPS of Rs (2.42) and an average RoNW of (23.96)%.

- If we attribute FY23 earnings to the post-IPO fully diluted paid-up equity capital of the company, then the asking price is at a P/E of 289.80.

- The debt-to-equity ratio for FY23 was 0.93.

What are the competitive strengths of Yatra Online Limited?

As per the company, their competitive strength is as below:

- They are the leading, full-service online travel company in India and one of the well-recognized travel brands in the country, addressing the needs of both leisure and business travelers.

- YOL has a large and loyal customer base.

- They have designed a unique “go-to-market” strategy that is a mix of B2C and B2B and this comprehensive approach creates a robust network effect resulting in cross-selling between business and leisure travelers.

- YOL has a single data center with an active data center backup in a separate location and also utilizes cloud services with the ability to restore all site operations within 48 hours in case of a complete shutdown.

Risks associated with Yatra Online Limited

Below are the risks associated with YOL:

- They may not be successful in pursuing strategic partnerships and acquisitions, and future partnerships and acquisitions may not bring them anticipated benefits.

- YOL has issued Equity Shares at prices that may be lower than the Offer Price in the last 12 months.

- Any negative operating cash flows in the future would adversely affect their cash flow requirements, which may affect their ability to do business and implement their growth plans, thereby affecting their financials.

The company derives a significant portion of its Adjusted Margin from B2B business, contributing 28.25% of the total Adjusted Margin in FY23. Changes in travelers’ preferences due to increased use of telepresence equipment, cost of travel, spending habits, and other factors may adversely affect the demand for travel services and hotel rooms, leading to adverse effects on their business.

Top Mutual Funds

Top Mutual Funds