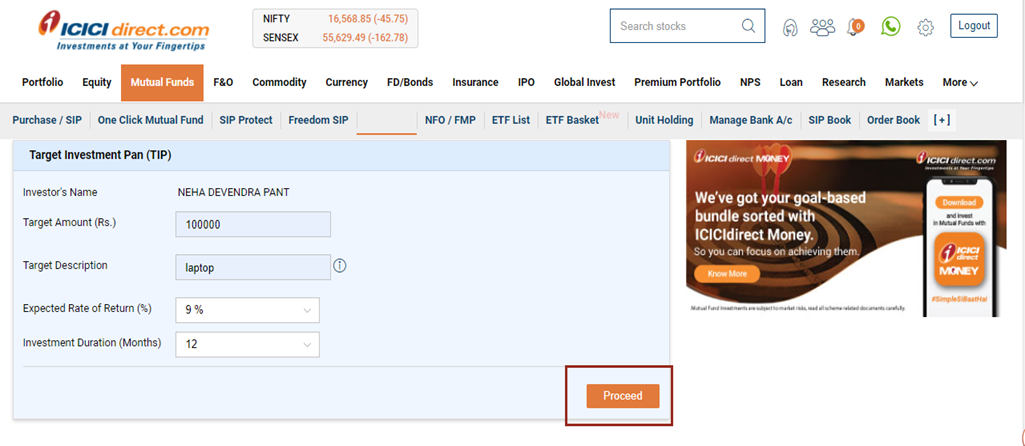

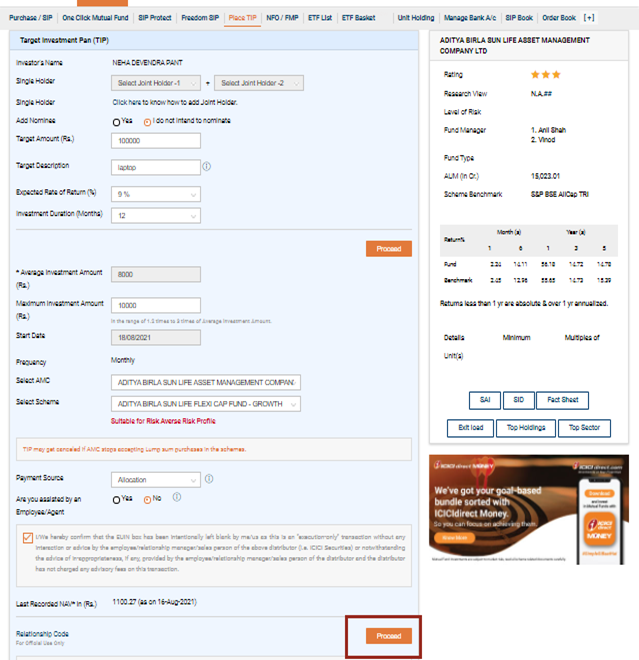

Let us take an example to understand the concept. In TIP you start by setting a target amount and an expected growth rate over the period of achieving the target. The longer the period the better is the opportunity to achieve the desired target amount.

Let's take an example to simplify the understanding:

Suppose you have a child who would study Medical after say seven years and if his/her fees to be paid at that time would be say around Rs.10 Lacs, you can start with your Target amount as Rs.10 Lacs.

The duration of the investment would be seven years and you expect the investments to grow at an expected rate of return of 12%.

|

Target Amount

|

10 Lacs

|

|

Expected Return

|

12%

|

|

Duration

|

84 months

|

|

Average Investment Amount

|

(Rs.) 7700

|

| TIP Dates |

Opening Portfolio Rs. |

Monthly installment

Rs.

|

Closing Portfolio

Rs.

|

Closing Portfolio

Rs.

|

|

7th March 2018

|

0

|

7700

|

7700

|

This is the first installment

|

|

7th April 2018

|

7000

|

7000

|

15500

|

Portfolio Value went down from Rs.7700 to Rs.7000.

Hence the monthly installment amount went up from Rs.7,700 to Rs.8,500

|

|

7th May 2018

|

17000

|

6300

|

23300

|

Portfolio Value went up from Rs.15500 to Rs.17000;

Hence the monthly installment amount went down from Rs.7700 to Rs.6300

|

|

7th June 2018

|

22000

|

9300

|

31300

|

Portfolio Value went down from Rs.23300 to Rs.22000;

Hence the monthly installment amount went up from Rs.7700 to Rs.9300

|

|

7th July 2018

|

33000

|

6300

|

39300

|

Portfolio Value went up from Rs.31300 to Rs.33000;

Hence the monthly installment amount went down from Rs.7700 to Rs.6300

|

As shown above, against your total investment of Rs.38100/-(Sum of monthly installments in 5 months), your current portfolio stands at Rs.39300/-

The plan thus establishes the target portfolio value by periodically calculating the investment amount, and bridging the gap between the target value and the actual portfolio value.

First investment amount: Your first investment amount would be Rs.7700/- which is equal to the average amount of investment.