BEST PERFORMING PORTFOLIOS IN ONE CLICK EQUITY BY MS. SANCHITA BOHRA, PRODUCT MANAGER, ONE CLICK EQUITY

There lies an intrinsic desire within each one of us to become the best version of ourselves. We try to do it by employing various methods. To boost our intellectual capacity and stay updated with the latest trends in the market, we enroll ourselves in various courses. To keep ourselves physically fit, we try to stick to a fitness regime and follow a balanced diet. To maintain our emotional well-being, we practice yoga and meditation.

The same principle also holds true for our investments. Why not park your hard-earned funds in the best performing portfolios to ensure safety as well as appreciation of the capital. We’ve got you covered! You can explore the Best Performing Portfolios in One Click Equity which have delivered stellar returns since their inception.

If you’re still wondering what One Click Equity is, it is a simple and offering which allows you to invest in theme based baskets of stocks and ETFs at a click. These portfolios are curated by our in-house Research Team after extensive analyses. These baskets typically constitute of 5-10 stocks each and are across fundamental and technical themes, with short term (15 days to 2 months) to long-term (3 -5 years) investment horizons. The ticket size starts from as low as Rs.700 per portfolio. It offers a wide range of various capabilities in just a few taps, from viewing, managing and tracking your portfolio to efficiently monitoring metrics.

Some of the best performing portfolios in One Click Equity are as follows:-

| Portfolio Name | Returns | Time Period |

|---|---|---|

| Potential Multi-baggers 2.0 | 79% | 1 year 5 months |

| Best Under 100 | 78% | 1 year 6 months |

| New Age Services | 74% | 1 year 6 months |

| Stocks under 12P/E | 55% | 1 year |

| Cement & Infra Multi-baggers | 53% | 8 months |

These portfolios are still open for investment. Returns are as on February 10, 2022.

One Click Equity is an unconventional solution created to meet the growing needs of discerning investors who need the convenience of managing their portfolios in just one tap. As a revolutionary and forward-looking solution, One Click Equity addresses investors' needs and challenges in simplifying their portfolios.

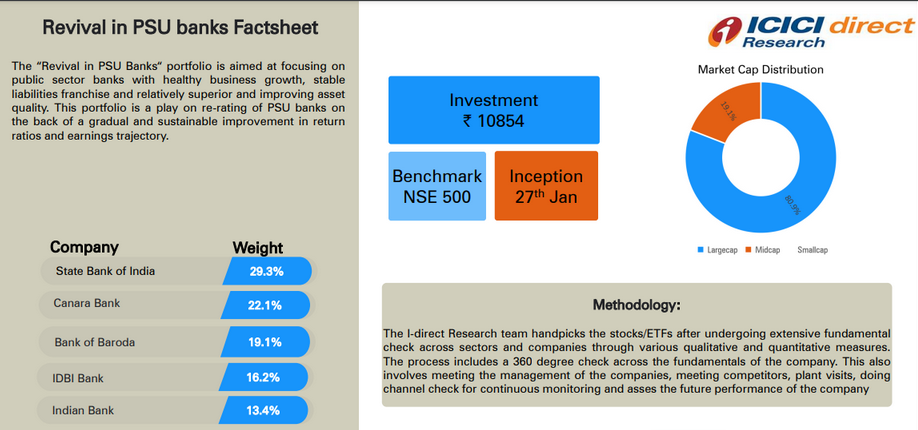

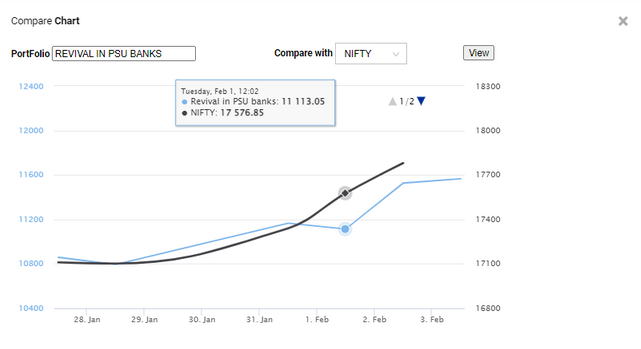

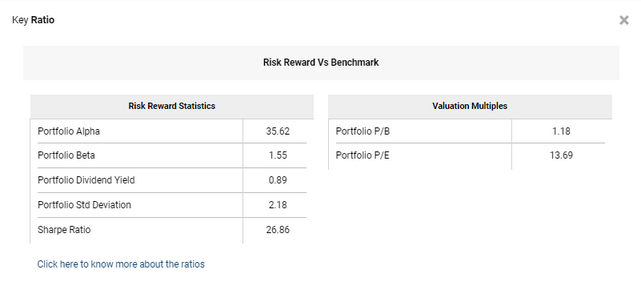

One Click Equity is broadly divided into 2 categories – Recommended One Click & Custom One Click. Recommended One Click is a handheld approach of investing wherein one can invest in portfolios curated by Research Team. Each portfolio curated by Research comes with a detailed Research Report highlighting the portfolio rationale, the benchmark index, the risk involved, the market capital distribution and the minimum amount required to invest in the portfolio. One can also compare the performance of these portfolios vis-à-vis the benchmark indices like Nifty 50, Nifty 200, Nifty 500 on a real-time basis. In order to aid the decision making process, significant ratios such as P/B (Price-to-Book ratio), P/E (Price-to-Earnings ratio) for the portfolio are also shared. The customers are also guided regarding the exit of these portfolios through mailers and notifications.

Portfolios in One Click Equity

Portfolio Report

Comparison of Portfolio Performance vs Indices

Key Ratios

On the other hand, Custom One Click gives customers the flexibility to create their own portfolios from scratch by adding their favorite stocks. One can enter/exit these portfolios as per their preference. Up to 50 stocks can be added in one portfolio.

One Click Equity is also available on the ICICIdirect Mobile App making it even more convenient for customers to stay on top of their investments. One can even share their favorite portfolios with their friends and family using the ICICIdirect Mobile App. All the features are kept handy and one can enter, monitor and exit portfolios in just a few taps.

One Click Equity on ICICIdirect Mobile App

One Click Equity brings with itself a host of benefits as it is packed with a lot of features and functionalities. Some of the advantages of investing in One Click Equity are as follows:-

- Diversification - As it is often said that “One should not put all one’s eggs in one basket”, One Click Equity is built on the maxim of diversification. It reduces risk to a great extent as one’s funds are invested in a basket of 7-10 stocks rather than an individual stock.

- Cost Effectiveness - There is no additional charge levied for investing in One Click Equity. The customer is simply charged the brokerage as per his/her pricing plan.

- No lock in - One can choose to exit the portfolios as per the Research recommendation or as per one’s preference. One can withdraw their funds once the portfolio has delivered expected returns or as per one’s needs since there in no lock in for these portfolios.

- Flexibility - One can choose to invest in the portfolios in a lump sum manner or in a staggered manner through SIPs. One can choose the frequency at which they wish to invest in the portfolios ranging from weekly to yearly.

In essence, One Click Equity is a flagship product of ICICIdirect which has transformed the way retail customers invest in equity markets by providing Research backed ideas coupled with a seamless investment platform.

Top Mutual Funds

Top Mutual Funds