|

|

ICICIdirect e-invest Account

|

|

.

|

What is unique about the ICICI Direct e-Invest account?

The ICICI Direct e-Invest account is more than just a trading account. It offers a unique 3-in-1 feature that seamlessly integrates your trading account, savings bank account, and demat account. This integration simplifies the entire investment process — from placing orders to settlements — by enabling automatic fund transfers and share movements with no paperwork. With this setup, online investing becomes smooth, convenient, and hassle-free.

|

|

|

|

|

.

|

What is the 3-IN-1 concept?

The 3-in-1 account combines your ICICI Direct trading account, ICICI Bank savings account, and ICICI Bank demat account. For this integration to work, both the savings and demat accounts must be opened with ICICI Bank. You may choose any ICICI Bank branch convenient to you for opening your bank account.

|

|

|

|

|

.

|

Can I have multiple demat accounts linked to my e-Invest account?

Yes, you can link up to four demat accounts to your e-Invest account. However, four is the maximum number of demat accounts that can be linked at a time.

|

|

|

|

|

.

|

Can I have multiple Bank accounts linked to my e-invest account?

No, currently you can link only one bank account to your e-Invest account.

|

|

|

|

|

.

|

What if I already have a demat or bank account with another bank or depository?

To benefit from the 3-in-1 account integration, your trading, bank, and demat accounts must all be held with ICICI Group. Accounts held with other banks or depositories cannot be linked for this service.

|

|

|

Top

|

|

|

|

|

|

Becoming a Customer

|

|

.

|

Who is eligible for this service?

All resident Indians, as well as Non-Resident Indians (NRIs) residing in Gulf Cooperation Council (GCC) countries — including the United Arab Emirates, Saudi Arabia, Bahrain, Kuwait, Oman, and Qatar — are eligible to avail this service.

|

|

.

|

How do I become an ICICIdirect customer?

You can open an ICICI Direct 3-in-1 account online by visiting the ICICI Direct website or through the mobile app.

|

|

|

|

|

.

|

How do I request an account opening form?

You can request a visit from our representative (available in Select Cities)

by registering online through our website. Alternatively, you may:

-

Visit any ICICI Bank branch or centre where our representatives can assist you.

-

Email us at

helpdesk@icicidirect.com

and our Customer Service Executive (CSE) will contact you to help complete the account opening process.

|

|

|

|

|

.

|

I have submitted my application. What happens next?

Your application will be reviewed, and you will be notified once it is accepted and your accounts are activated. If there are any missing or incorrect details, our representative will contact you via call or email to complete the process.

|

|

|

|

|

.

|

How do I know if my application has been accepted?

You can track your application status by visiting the “Know Your Account Status” section under the Customer Service page on www.icicidirect.com. You will also receive an email confirmation once your account has been successfully opened.

|

|

|

|

|

.

|

Do I need to maintain a minimum balance in my bank account?

Yes, the Monthly Average Balance (MAB) requirement will depend on the specific savings account variant you open with ICICI Bank.

|

|

|

Top

|

|

.

|

What documents will I receive once my ICICI Direct account is opened?

Once your account is successfully opened, you will receive the following:

-

A PIN mailer containing your user ID and password for ICICIdirect, sent by ICICI Securities Ltd

-

A cheque book and ATM-cum-Debit Card (if a new savings account was opened), sent by ICICI Bank Ltd.

-

A Membership Guide and internet banking credentials for your demat account, sent by ICICI Bank Demat Services

Note:

The Transfer Instruction Delivery Booklet (TIDB) will be sent to your registered address.

|

|

|

|

|

.

|

When is a trading account termed as ‘Inactive’ or ‘Dormant’?

A trading account is considered inactive or dormant if no trades are placed across any exchange or segment for a period of one year. ICICI Direct does not freeze such accounts; however, any new trade initiated from an inactive or dormant account will be subject to additional due diligence and verification, as deemed necessary by ICICI Direct.

Customers are notified via email when their account is marked inactive. If no action is taken within the specified timeframe, the account may be temporarily suspended.

|

|

|

|

|

|

Existing ICICI Customers

|

|

.

|

If I already have an ICICI Bank account and an ICICI Demat account, can I use them for online investing?

Yes, you can use your existing ICICI Bank and ICICI Demat accounts for trading. All fund transactions will be debited from or credited to the bank account linked to your ICICIdirect trading account.

|

|

|

Top

|

|

|

|

|

|

FAQs on Bank/Demat Account

|

|

.

|

What type of Bank Account can I use with my e-invest account?

You will need a savings bank account with ICICI Bank. This account must be linked to your e-Invest account. If you don’t already have an ICICI Bank account, a new online savings account will be opened for you as part of the e-Invest account setup.

|

|

|

|

|

.

|

How frequently can I check the status of my accounts?

You can access the status and details of your bank, demat, and e-Invest accounts online 24/7 through the ICICIdirect platform. All trade-related updates and order information are available in real time. Trade outcomes will also reflect in your linked bank and demat accounts on T+1 working day, eliminating the need to wait for statements.

|

|

|

|

|

.

|

What is an ICICI Bank Online Banking account?

ICICI Bank’s online banking service is called Infinity. When you open an ICICI Direct e-Invest account, a linked ICICI Bank savings account is also opened, which is compatible with the Infinity platform.

You can access Infinity via www.icicibank.com

using a secure login ID and password. It allows you to view your account balance, transaction history, transfer funds, and make online bill payments.

If you've opened a new bank account or linked an existing account not registered with Infinity, your login credentials will be sent to you separately. However, this will not impact your ability to trade on ICICI Direct.

|

|

|

Top

|

|

|

|

|

|

New ICICIdirect e-invest Customers

|

|

.

|

I am a new customer and have just been informed that my ICICI Direct e-Invest account is active. How do I place my first trade?

You can begin by learning how to trade through these resources:

Once you're familiar, log in to icicidirect.com and navigate to the “Place Order” section to begin trading.

|

|

|

|

|

.

|

I want to buy some shares, but I don’t have money in my bank account. What should I do?

You need to first deposit funds into your ICICI Bank account. You can do this by:

-

Depositing cash or a cheque using a pay-in slip

- If depositing a cheque, wait for it to clear before proceeding.

Once the funds are credited, allocate the desired amount for trading via the ICICI Direct web platform or app. Alternatively, you can sell existing shares from your demat account in the cash segment and use the proceeds to buy shares.

The amount you need to allocate will depend on the total value of your intended order.

|

|

|

|

|

.

|

I’ve deposited a cheque but still can’t place a purchase order. Why?

There could be two reasons:

1. The cheque hasn’t cleared yet. Please check with your ICICI Bank branch to confirm the clearance status.

2. You haven’t allocated funds for trading. Even if the funds are available in your account, they need to be explicitly allocated for trading or investment on ICICIdirect.

|

|

|

|

|

.

|

Can I withdraw the amount allocated for trading?

Yes, just as you can allocate funds for trading, you can also reduce the allocated amount — provided it hasn’t been blocked due to any pending orders. Once funds are deallocated, they can be withdrawn from your linked ICICI Bank account.

|

|

|

|

|

.

|

Can I borrow or get a line of credit against my Demat Account?

Currently, this service is not offered. However, we are actively exploring such features. Your feedback on this requirement is welcome and will help shape future offerings.

|

|

|

Top

|

|

|

|

|

|

FAQs on Online Investing

|

|

.

|

On which exchanges can I buy and sell shares?

ICICI Direct provides execution capabilities on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

|

|

|

|

|

.

|

What kind of orders can I place?

You can place two types of orders:

-

Limit Order: You specify the maximum price you are willing to pay for a buy order, or the minimum price you are willing to accept for a sell order. The trade will only be executed if the market reaches your specified price or better.

-

Market Order: This order executes at the best available price in the market at the time of placement. It typically has a higher chance of execution. Market orders can only be placed during exchange trading hours.

Note (NSE specific market order):

If a market order is not fully executed, the remaining quantity is automatically converted into a limit order at the last traded price.

|

|

|

|

|

.

|

Which shares can I buy and sell?

You can trade shares listed in the Cash Segment that are in compulsory dematerialised form on NSE and BSE. The list of eligible stocks is updated regularly based on regulatory guidelines.

Additionally, select stocks are available for trading in the Margin Segment as well.

|

|

|

|

|

.

|

Will I get online confirmation of orders and trades?

Yes, all orders and trades are confirmed online in real time. Once you place an order, it is validated and sent to the exchange without any manual intervention.

You can track the status in the Order Book. At the end of the trading day, you will receive:

- An email confirmation of your trades

-

Digitally signed contract notes via email

-

Access to contract notes under:

Login >> Stocks >> Reports >> Digital Contract Note

|

|

|

|

|

.

|

Is it guaranteed that an order will be executed in full or at one price?

No. Execution depends on market conditions:

-

A limit order may remain unexecuted if there are no matching bids or offers at your specified price

-

Partial executions are possible. The remaining quantity becomes a new order for the balance.

-

Each executed portion could happen at a different price, especially in fast-moving markets.

For market orders:

-

If no matching orders exist, the unexecuted quantity is automatically converted into a limit order at the last traded price.

-

If the last trade happened at ₹100, and only 40 out of 100 shares were sold, the remaining 60 will be converted into a limit order at ₹100.

-

If the last execution occurred at ₹95, then the limit for the remaining order will be ₹95.

If the price of the opposite-side order goes beyond the Maximum Price Interval (MPI) range, the unexecuted portion may be cancelled entirely.

|

|

|

|

|

.

|

Can I modify my order?

Yes, you can modify your order any time before it is executed. To do this, go to the Order Book on ICICI Direct and click the ‘Modify’ link next to the relevant order.

However, you cannot modify an order while it is queued with the exchange (i.e. when confirmation is pending). If the order is partially executed, only the unexecuted portion can be modified.

|

|

|

|

|

.

|

Can I cancel my order?

Yes, you can cancel any order that hasn’t been executed yet. Visit the Order Book and click the ‘Cancel’ link next to the order you wish to cancel. If the order is already partially executed, only the unexecuted portion can be cancelled.

|

|

|

|

|

.

|

Can I place orders after trading hours? What happens to them?

Yes, you can place limit orders after trading hours. These are queued in the system and sent to the exchange when the market reopens (either in the pre-open or normal trading session). The order status will show as ‘Requested’ in your Order Book until it's sent to the exchange.

|

|

|

|

|

.

|

Do I need funds before placing a buy order?

Yes, you must have sufficient funds in your linked ICICI Bank account before placing a buy order. Alternatively, if you've sold shares, you can use the sale proceeds to buy other shares.

|

|

|

|

|

.

|

Can I go short?

Yes, short selling is allowed in the Margin Product. However, short positions must be squared off before the specified time on the same trading day. You cannot short sell under the Cash Product, where you may only sell shares that are available in your demat account.

|

|

|

|

|

.

|

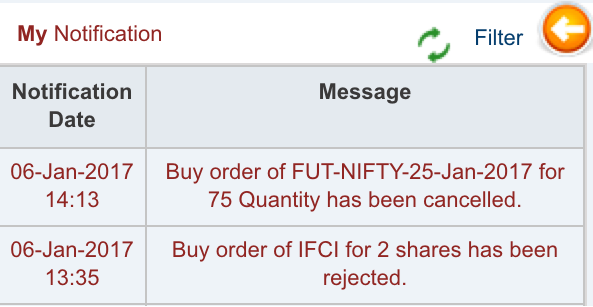

How will I be informed of my trade execution?

Trade executions are confirmed online in real time. You can view order status in the Order Book, where it updates to ‘Executed’ or ‘Part Executed’ accordingly. Details of executed trades are also available in the Trade Book by clicking the relevant Order Reference Number.

Additionally, you will:

-

Receive an email confirmation

-

Get a digitally signed contract note at the end of the day

-

Be able to download your notes under:

Login >> Stocks >> Reports >> Digital Contract Note

You can choose to receive trade confirmations either per trade or consolidated at the end of the day.

|

|

|

|

|

.

|

What is a contract note?

A contract note is a legally valid confirmation of the trades executed on your behalf during a trading day. It includes trade details in the prescribed format and is shared in duplicate — one copy for you and one for the broker. This document formalises the trade between you and the brokerage.

|

|

|

|

|

.

|

Can I trade on margin?

Yes, margin trading is available on select stocks. You can use this facility to buy or sell shares with partial capital upfront, subject to eligibility and risk profiling.

|

|

|

|

|

|

|

|

.

|

What is a Disclose Quantity (DQ) order?

A Disclosed Quantity (DQ) order allows you to show only part of your total order quantity to the market at a time.

For example:

If you place an order to sell 1,000 shares with a DQ of 200, only 200 will be visible to the market initially. Once that’s traded, the next 200 will be revealed, and so on.

-

On NSE, DQ must be at least 10% of the total order but less than the full order quantity.

-

On BSE, the DQ must be at least 10% or 1,000 shares, whichever is lower, and also less than the full order quantity.

|

|

|

|

|

.

|

What is a Stop Loss order ?

A Stop Loss order allows you to limit your potential losses by automatically placing a buy or sell order when the stock reaches a specified price, known as the Stop Loss Trigger Price (SLTP).

Examples 1 : Stop Loss Buy Order

Suppose you’ve short sold Reliance at ₹325, expecting a fall. To limit loss if the price rises, you place a Stop Loss buy order with:

- SLTP = ₹345

- Limit Price = ₹350

If the stock hits ₹345,the system places a buy order at ₹350.

Example 2: Stop Loss Sell Order

You buy Reliance at ₹325 expecting a rise. To limit loss if it falls, you place a Stop Loss sell order with:

- SLTP = ₹305

- Limit Price = ₹300

If the price drops to ₹305, a sell order is placed at ₹300.

Important:

-

For a buy Stop Loss order, the SLTP must be higher than the last traded price.

-

For a sell Stop Loss order, the SLTP must be lower than the last traded price.

|

|

|

|

|

.

|

What are price bands?

Exchanges define price bands to limit how much a stock can move in a single trading day.

-

Most stocks can move within a band of ±20% from the previous day’s closing price.

-

Stocks under derivatives or with high volatility may have tighter bands like ±5% or ±10%.

-

Orders placed outside the permitted range are rejected by the exchange system.

If a member wishes to place an order beyond the defined price band (especially for derivatives), they must request the exchange to temporarily relax the limit.

|

|

|

|

|

|

Top

|

|

|

Advanced Order

|

|

|

|

|

|

Multi Price Order in Cash

|

|

|

Top

|

|

.

|

Why am I unable to place certain orders or perform certain actions in this product?

Certain orders and actions have been restricted to comply with regulatory norms related to securities settlement. As per SEBI guidelines, netting off of trades has become mandatory, which limits some order types and actions.

To view the full list of restricted features, please refer to the detailed guidelines on the ICICIdirect platform click here..

|

|

|

Top

|

|

|

Buy Today Sell Tomorrow® (BTST®)

|

|

|

|

|

.

|

What is Buy Today Sell Tomorrow® (BTST®) ?

Buy Today Sell Tomorrow® (BTST®) is a facility that allows you to sell shares even before they are credited to your demat account. This means you don’t have to wait for the standard settlement (T+1) to complete.

With BTST®, you gain early liquidity as you can exit the position on the same or next trading day without waiting for delivery from the exchange.

How can I place a BTST®order ?

To place a BTST®order:

1. Go to the Security Projections page on ICICIdirect.

2. Click the BTST® Sell hyperlink next to the relevant stock.

3.Fill in the order details, similar to a normal cash sell order

Can I place a BTST® order through the normal Cash Sell order entry page?

Yes, you can place a BTST® order using the Cash Sell order entry page. However, if the order quantity exceeds your total available quantity (i.e. day’s buy quantity + demat allocation), the system will automatically split your order into two parts — regular sell and BTST®sell.

Example:

Let's say:

-

Day buy quantity for ACC = 10

-

Demat allocation quantity for ACC = 20

- Total BTST® eligible quantity = 30

Case 1: Placing a Cash Sell order for 45 shares on NSE:

The system will automatically break the order as follows:

- 30 shares (Day Buy + Demat Allocation) – placed as a normal sell order on NSE

-

15 shares – placed as a BTST® sell order on NSE

Case 2: Placing a Cash Sell order for 45 shares on BSE:

The system will break it into:

-

30 shares (Day Buy + Demat Allocation) – normal sell order on BSE

-

15 shares – BTST® sell order on BSE

What is the maximum number of shares I can sell under BTST®

You can view the maximum number of shares available for BTST® under the ‘Maximum Quantity Permitted’ column on the Security Projections page. This quantity is calculated based on your net buy position in the respective settlement and ICICI Direct's internal risk parameters for that stock.

When you place a BTST® order:

-

The order quantity is added to the Blocked Quantity

-

The Available Quantity is reduced accordingly

You can continue placing additional BTST® or normal sell orders up to the available quantity

Why is BTST® quantity shown in both Blocked Quantity and Current Day Quantity?

As per updated settlement rules, BTST® sell quantity is also netted against the same-day buy quantity during end-of-day (EOD) processing.

-

During the day: BTST® quantity is shown as both blocked and adjusted against same-day transactions

-

After EOD: Your holdings and limits are updated to reflect netting outcomes

Despite interim display changes, you can place cash sell orders up to the net bought quantity during the trading day.

Can I use BTST® if the current settlement is ongoing?

No, BTST® can only be used after the buy-side settlement is complete. You cannot use BTST® for shares still under the same ongoing settlement cycle

How many scrips are available for BTST® ?

BTST® is allowed for most NSE-listed stocks. However, ICICI Direct restricts this facility for certain stocks based on internal criteria such as:

- Low liquidity

-

Exchange surveillance lists (e.g., GSM)

-

Stocks linked to suspicious messaging activity (e.g., fake SMS scrips)

ICICI Direct reserves the right to modify this list at its discretion.

What happens if delivery of shares sold under BTST® is not received from the exchange?

If there is a short delivery in your initial buy transaction, you will also face short delivery in your BTST® sell transaction.

- The exchange may deliver shares via auction or may close out your buy trade.

-

However, by the time the auction is processed, your sell-side settlement may already be due.

-

In this case, you will be liable for auction penalties, losses, and other incidental charges.

-

ICICI Direct will not be responsible for short deliveries from the exchange or any resulting impact.

-

Your cash limits will be reduced temporarily to cover the potential auction loss. These limits will be adjusted once actual auction proceeds are known.

What happens if shares bought under Delivery are not received from the Clearing Corporation?

With Direct Pay-out, shares are credited directly to your demat account. If shares are not received, it could be due to:

- A shortfall from the clearing corporation

- An invalid or dormant mapped demat account

Example:

You buy 100 shares on Monday. If a shortfall occurs on Tuesday (settlement day), and you receive only 40 shares via auction on Wednesday:

- 40 shares will appear in your demat holdings

-

For the remaining 60 shares, funds will be credited once received as part of a close-out

What happens if I sell Delivery shares before they’re received from the Clearing Corporation?

During T+1 EOD processing, if a shortfall is detected:

-

Your cash limit will be blocked equal to the value of the sell trade plus a 20% markup, regardless of your available limit.

- On T+2, shares will either be received through auction or funds will be credited for the shortfall.

Example:

You buy 100 GAIL shares at ₹100 and sell them the next day at ₹105. A full shortfall is detected:

-

₹12,600 (105 × 100 + 20%) is blocked

-

On T+2, if 40 shares are received via auction, the rest (60 shares) are settled via fund credit (e.g., 60 × ₹107 = ₹6,420)

What if I sell shares bought under Delivery before receiving them, but I already hold the same stock in my demat account?

In such a case, if there is a shortfall from the clearing corporation:

- BTST® sell quantity will be adjusted against both auction delivery and your existing holdings

- The remaining shares will be deducted from your demat holdings

-

Funds for the shortfall portion will be credited after the close-out

Example:

You bought 100 shares of GAIL and sold them as BTST at ₹105. You already hold 1,000 shares of GAIL.

-

On T+2, if you receive 40 shares via auction, they are adjusted against the BTST sell

-

The remaining 60 shares are deducted from your existing 1,000-share holding

-

Updated holding = 940 shares

-

Close-out amount for 60 shares will be credited to your account

Can Non-Resident Indians (NRIs) opt for BTST®?

No. Currently, BTST® is not available to NRIs.

What is the applicable brokerage for BTST® trades?

The brokerage rates for BTST® trades are the same as those applicable for regular cash market trades.

Will the shares be credited to my demat account?

Yes, under the Direct Pay-out of Securities Mechanism, securities are directly credited to the primary/default demat account mapped to your ICICIdirect profile.

If shares are sold under BTST®, they are allowed to the extent of shares bought in the previous day’s settlement.

What happens if shares are deallocated? Can I allocate them and then place BTST® or Cash Sell orders?

Yes, you can manually allocate shares from the ‘Allocate’ section on the Demat Holdings page. Here's how:

-

Enter the total demat balance quantity as pre-populated.

-

The difference between the unallocated (free) quantity and the previous day’s buy quantity will be auto-allocated.

- If the scrip is BTST-enabled, shares bought the previous day can be sold.

Order placement options:

- For Cash Sell, place the order via the Place Order or Demat Holdings page.

- For BTST® Sell, use the Securities Projection (BTST) page.

Example:

-

You have 100 free shares and bought 40 more yesterday.

- On the next day, you can allocate 60 shares and place a Cash Sell order, while the remaining 40 can be sold via BTST®

What happens if shares have been auto-allocated and I want to place a BTST® or Cash Sell order?

If auto-allocation is successful, you can place both Cash Sell and BTST® orders as per the updated holdings.

Example:

- You bought 100 shares earlier, and 40 shares yesterday.

- On T+2, 100 shares get auto-allocated.

- You can now:

- Place a Cash Sell order for 100 shares

- Place a BTST® Sell order for 40 shares

|

|

|

Settlement of Trades

|

|

.

|

What is a settlement cycle?

The settlement cycle is T+1, which means trades are settled one business day after the trade date.

|

|

|

|

|

.

|

If I have purchased a share, do I have to take delivery?

- Rolling Segment: You may sell the share before the end of the settlement cycle. However, if you hold it beyond the cycle, you must take delivery by paying for it.

- TT Segment: Settlement is done without netting off positions. If you purchase shares, you must mandatorily take delivery. Selling the same shares in the same settlement is not allowed.

The segment for each stock can be checked in the ‘Stock List’.

|

|

|

|

|

.

|

If I have sold some shares, can I use the cash projections from the sale to buy other shares?

Settlement of funds is done on a net basis for each segment:

- Cash from sale of TT Segment stock can be used only to buy TT Segment stocks.

- Cash from sale of Rolling Segment stock can be used only to buy Rolling Segment stocks.

- No cross-usage is allowed between TT and Rolling segments in the same settlement.

From the next trading day, however, net cash projections of one segment can be used in another, since the payout of the earlier settlement will have been completed before the pay-in of the next settlement.

The Segment to which the stock belongs can be seen from the 'Stock List'.

|

|

|

|

|

.

|

Why is part of my sell trade value for Cash product transactions being withheld for the day?

As per SEBI regulations, 20% of the sell value is required as upfront margin. Hence, only 80% of the sell value is made available for fresh trades on the same day, and the withheld 20% is released after market hours for the next trade date.

- If the sell trade follows a buy trade (same stock, same exchange, same quantity): The transaction is treated as intraday (except BTST and CTD sells), and no margin is withheld.

- If the sell trade is done first, then a buy trade: The sell is treated as a delivery transaction, and 20% margin is withheld.

- BTST Transactions:

○

T+1 day in T+2 settled stocks: 40% of the sell value is withheld. Half of this (20%) is released at EOD on T+1, and the rest on T+2.

○

T+2 day in T+2 settled stocks or T+1 day in T+1 settled stocks: 20% of the sell value is withheld and released the next trade day (similar to cash sells).

Example

-

On Sept 21, if you sell stock in BTST (bought on Sept 20) for ₹100:

○ ₹40 will be withheld, ₹60 released instantly.

○ Out of the ₹40 withheld, ₹20 is released at EOD on Sept 22, and the remaining ₹20 at EOD on Sept 23.

You can view withheld amounts in the Trade Book (Equity) or under ‘Converted to Delivery’ on the Margin page.

|

Important Update on MTF Positions (effective Feb 28, 2025)

- Margins released on square-off of existing Pay Later/MTF positions will no longer be available for fresh buying on the same day.

- Released margins will move to Withheld Margin and can only be:

○ Used the same day for adding margin to existing MTF positions via the

Add Margin feature.

○ Used for fresh trades only from T+1 (next day).

No impact on same-day MTF buy and sell trades — margins continue to be usable immediately.

Example:

- On Mar 3, 2025, you create an MTF position worth ₹10,000 with ₹3,000 margin.

-

On Mar 4, you sell it:

○ The ₹3,000 moves to Withheld Margin (usable only for Add Margin that day).

○ At EOD on Mar 4, the ₹3,000 is released for use or withdrawal from Mar 5 onward.

-

If you sell on the same day (Mar 3), margins remain available for reuse on the same day.

|

|

|

|

.

|

If I have sold, do I have to give delivery of shares?

- Rolling Segment: You may buy back the shares before the end of the settlement cycle. If not, you must give delivery from your demat account.

- TT Segment: There is no netting-off. If you sell shares, you must mandatorily give delivery. Any purchases in the same settlement are treated separately and do not offset the delivery obligation.

The segment for each stock can be checked in the ‘Stock List’.

|

|

|

|

|

.

|

I buy a share, how will the payment be made and how will I get the shares?

- Payment: Made on the Pay-In day, based on the settlement cycle and the exchange. The money is debited directly from your linked bank account.

- Shares: Received from the exchange and automatically credited to your demat account.

A similar process applies when you sell shares.

|

|

|

|

|

.

|

I have bought some shares but some amount has not been deducted from my bank account.

The amount is debited from your linked ICICI Bank account on the trade day itself.

You can check the exact debit date on the Cash Projection page.

|

|

|

|

|

.

|

I have bought some shares but they have not come into my demat account.

Shares are credited to your demat account on the Pay-Out day (T+1 working day).

- The Order Verification screen at the time of placing a buy order shows the expected credit date.

- Alternatively, if shares are not received due to short delivery by the counterparty broker, the exchange conducts an auction to procure them.

- If shares are still not received in the auction, the exchange recovers penalty from the defaulting broker and compensates the buyer with the equivalent consideration.

|

|

|

|

|

.

|

I have sold some shares but the payment has not come into my bank account.

Sale proceeds are credited to your linked bank account on the Pay-Out day (T+1 working day).

|

|

|

|

|

.

|

What is a short delivery?

Short delivery occurs when a seller fails to deliver shares (partly or fully) during a settlement cycle.

You can view details of any short delivery in the My Messages link under the Equity page.

|

|

|

|

|

.

|

What is an auction?

An auction is conducted by the exchange to fulfill delivery obligations to buying members when selling members fail to deliver shares.

- If shares are short-delivered, bad deliveries, or company objections are not rectified, the exchange buys the required quantity from the market and allots them to the buyer.

- Auctions are generally held on Fridays.

|

|

|

|

|

.

|

What factors give rise to an auction?

The primary reason is short delivery of shares by selling members.

|

|

|

|

|

.

|

What happens if the shares are not bought in the auction?

If shares cannot be bought in an auction:

- The transaction is financially closed out as per SEBI guidelines.

-

The close-out price is the higher of:

○ The highest traded price of the scrip between the trade day and the auction day, OR

○ 20% above the last available closing price on the auction day.

- Funds are adjusted during the pay-in/pay-out process of the relevant auction.

|

|

|

Top

|

|

.

|

What happens in case of Internal Shortage within ICICI Securities (when both Buyer and Seller are ICICI Securities’ clients)?

Internal shortage occurs when both the buyer and seller are ICICI Securities’ clients and the seller defaults in delivering securities. In such cases, the buyer may not receive shares on the settlement day (T+1).

As per SEBI Circular (SEBI/HO/MIRSD/MIRSD-PODI/P/CIR/2024/75 dated June 05, 2024) and NCL Circular (NCL/CMPFT/66688 dated February 14, 2025, effective February 25, 2025):

- Securities payout will be credited directly to the client’s demat account by the clearing corporation/depositories (NSDL/CDSL).

- For any shortage (including internal shortages), brokers must use the auction mechanism prescribed by the clearing corporation (CC).

- The policy for settling shortages will follow CC guidelines from time to time.

A. In Case of Sell Trade Internal Shortage:

- All internal shortages will be reported to CC, which will conduct an auction.

- Settlement-wise and product-wise (Cash Sell, ATM, BTST, MTF Sell/BTST, SPOT Sell, etc.) shortages will be reported on settlement day.

- CC will debit the auction valuation amount from ICICI Securities’ settlement account, which will be blocked from the seller’s funds/securities.

- If shares are not received in the auction due to reasons like valuation not paid, corporate action, unsuccessful auction, or incorrect reporting, the position will be financially closed out at the CC auction rate or, if unavailable, at CC’s close-out rate.

- If neither auction nor close-out rate is available, the highest price of the scrip from Trade Day to Settlement Day will be used as the internal shortage close-out rate.

- Auction/close-out charges debited by CC will be recovered from the seller client.

B. In Case of Buy Trade Internal Shortage:

- If the buyer does not receive securities on settlement day, CC will conduct an auction and credit shares on the auction settlement day.

- If securities cannot be delivered even after the auction, the position will be financially closed out at CC’s close-out rate (or, if unavailable, at the internal shortage close-out rate — the highest price from Trade Day to Settlement Day).

- Auction amounts will be credited to the buyer on auction settlement day or within one working day thereafter.

Valuation Amount:

This will be based on the settlement price of the scrip plus an additional 20% markup (or as specified by CC from time to time).

For MTF Product Customers with Buy Positions:

- If an MTF buy position is marked for payout shortage, the position will continue until auction settlement day.

- If securities are received and marked under MTF pledge, the position continues as is.

- If securities are not marked under MTF pledge, the position will be squared off.

- If CC does a financial close-out on auction settlement day, the quantity will be closed through “Convert to Delivery” (CTD) mode, and any close-out amount will be credited to the client.

- If the client squares off the MTF position before auction settlement day, it will be treated as a sell shortage and settled under the above process.

What will happen if the delivery for MTF securities bought by me is not received from the clearing corporation?

On T+2 day, the delivery may come through auction, funds close-out, or a mix of both:

- If securities are received in auction → they will be auto-pledged under MTF and made available to you.

- If funds close-out is received → ICICI Direct will close your MTF open position (to the extent of shortage) using the Convert to Delivery (CTD) feature. The equivalent funds will be credited once received from the Clearing Corporation.

Example:You buy 100 shares in MTF on Monday. On settlement date (Tuesday), there’s a shortage for the full 100 shares. On Wednesday (T+2), 40 shares are received via auction and auto-pledged. For the remaining 60 shares, funds close-out is received and 60 shares are closed through CTD. Your MTF open position reduces to 40 shares.

|

|

|

Top

|

|

|

What is CUSPA? (Client Unpaid Securities Pledgee Account)

The shares bought under delivery products which are not fully or partly paid shall be transferred to the ‘Client Unpaid Securities Pledgee Account’ (CUSPA) and the same shall be auto-pledged in favour of ICICI Securities Ltd under CUSPA. The outstanding obligation at the end of T-day, along with combined ledger balances, shall be considered for the calculation and accordingly the shares will be considered for pledging under CUSPA. Communication about outstanding obligations shall be sent to the client via ‘Email’ and ‘My Messages’ about and Clearing Corporation shall transfer the shares to CUSPA.

|

|

|

Top

|

|

|

What actions does ICICI Securities take to liquidate CUSPA shares if I do not fulfil my outstanding payment obligations?

On settlement date, such shares are eligible for Buy Today and Sell Tomorrow (BTST) transactions. However, if the customer fails to clear the outstanding obligation on the settlement date, ICICI Securities will liquidate the pledged securities to recover dues on T+2 days onwards on the best-efforts basis. Brokerage & charges as applicable.

|

|

|

Top

|

|

|

How can my shares will be released from CUSPA?

If you fulfil the outstanding funds obligation on or before the settlement and before CC transfers, then such shares pledged to CUSPA will be released and the securities will be available as free balance in your demat account. In case only partial outstanding balance is cleared, then proportionate shares shall be released after the completion of the required processes.

|

|

|

Top

|

|

|

Why am I unable to place certain orders when that stocks are present under CUSPA holdings?

If you have any stocks held under CUSPA holdings, you won’t be able to place new orders in the below products in both the exchanges until the shares are marked under CUSPA.

1. MTF Buy

2. Cash Buy including SEP / OneClick etc.

3. GTT

4. MTF T+n day CTD

|

|

|

Top

|

|

|

|

|

|

Margin Product – Cash Margin and Debit/Credit Process

|

|

|

Note: The term “Client Mode” is now referred to as “MTF Buy” (Buy Today & Pay within 1 year).

Please interpret “Client Mode” accordingly wherever it appears in your ICICI Direct interface.

|

|

|

|

|

.

|

What is Margin Trading / Trading in the Margin Segment at ICICI Direct?

Margin Trading allows you to take buy/sell positions in stocks by paying only a fraction of the trade value (the margin), enabling you to leverage your capital.

Positions are expected to be squared off within the same settlement cycle unless converted to delivery.

If prices move in your favor:

If prices move against you:

However, you can choose to take delivery of buy positions (or give delivery for sell positions) if you have sufficient funds or shares.

|

|

|

|

|

.

|

Why is my Pledge not confirmed in MTF?

Under the Direct Payout facility, shares purchased under MTF are transferred to your mapped demat account followed by creation of an auto-pledge in favour of ‘Client Securities under Margin Funding Account’. If the pledge cannot be established due to an inactive, frozen, or suspended demat account or any other reason which are beyond our control, I-Sec reserves the right to settle, square off, or close out such unconfirmed positions within five trading days from the payout date.

|

|

|

|

|

.

|

What is CSMFA (Client Securities under Margin Funding Account) and why are my shares auto pledged in MTF in CSMFA?

It is an account the broker maintains with the depositories to manage pledges of securities bought through the Margin Trading Facility (MTF). When you purchase shares under MTF, they are automatically pledged in favour of ICICI Direct – CSMFA in your demat account. If the pledge cannot be created, any unconfirmed MTF position will be squared off (closed) within five working days of the payout date.

|

|

|

|

|

.

|

How is Margin Trading different from the Cash Segment?

|

Aspect

|

Cash Segment

|

Margin Trading Segment

|

|

Settlement Type

|

By Delivery (unless squared off intraday)

|

Intraday square-off unless converted

|

|

Funds/Shares Requirement

|

100% of buy value or full holding for sell

|

Partial margin only

|

|

Aspect

|

Cash Segment

|

Margin Trading Segment

|

|

Leverage

|

None

|

Yes, higher trading exposure

|

|

Risk

|

Lower

|

Higher (due to leverage)

|

|

Conversion to Delivery

|

Not applicable

|

Possible if adequate funds/securities available

|

Example:

- A Cash Buy of 100 shares of Reliance requires full payment.

- A Margin Buy allows you to take the same position by blocking only a percentage (say 20–25%) of the value.

- A Margin Sell can be placed even without holding the shares, provided sufficient margin limits are available.

Note: While Margin Trading allows higher exposure, it also increases risk due to leverage.

For details on margin percentages and stock eligibility, visit the Stock List under the Equity section of the Trading page after logging in.

|

|

|

|

|

.

|

What do ‘Broker Square-Off’ and ‘Client Square-Off’ mean in the Margin Product?

Broker Square-Off Mode:

- Under this mode, all unexecuted Margin Buy/Sell orders and open Margin Buy/Sell positions marked as ‘Broker’ will be treated as intraday positions.

- These orders and positions are automatically cancelled or squared off by ICICI Securities Limited (I-Sec) during the End of Settlement (EOS) process for the current settlement cycle.

- The EOS process timing is at I-Sec’s discretion.

Client Square-Off Mode:

- Under this mode, all unexecuted Margin Buy orders and open Margin Buy positions marked as ‘Client’ will not be squared off by I-Sec during the EOS process (except for certain exceptions mentioned below).

- The responsibility to square off such positions within the stipulated time (currently 360 days) rests with the client.

- Exception: For price-band scrips (where the stock price moves beyond a predefined percentage) or in special circumstances determined by I-Sec, the position may be squared off at I-Sec’s discretion.

- Client Square-Off Mode is also referred to as Margin Trading Facility (MTF) or Pay Later.

|

|

.

|

Can I place ‘Broker Square-Off’ and ‘Client Square-Off’ orders on both NSE and BSE?

Yes.

You can place both Broker and Client Square-Off mode transactions on NSE and BSE.

For Client Mode (MTF) positions, the maximum holding period is 360 days on both exchanges.

|

|

|

|

|

.

|

What is the Intraday Page?

The Intraday page displays all Margin positions taken in the current settlement and provides the following facilities:

- Add Margin – Add additional funds or limits to support your open positions.

- CTD (Convert to Delivery) – Convert your margin position into a cash position and take delivery of shares.

- Square Off – Close your open margin position by placing a square-off order.

Change Mode – Switch between Broker and Client square-off modes for eligible open positions.

|

|

|

|

|

.

|

What is the MTF (Pay Later) Page?

The MTF (Pay Later) page displays all your open Margin Buy positions taken under Client Square-Off Mode that were not squared off in earlier settlements.

It is similar in layout to the Margin Positions page and provides detailed position-level data, including:

|

Details Displayed

|

Description

|

|

Stock Code & Expiry Date

|

Identifies the scrip and expiry of the position.

|

|

Open Quantity

|

Quantity of shares still held under MTF.

|

|

Average Price & Current Price

|

Entry price and current market price.

|

|

Initial Margin Amount

|

Margin originally blocked for the trade.

|

|

Amount Payable

|

Outstanding amount to be funded.

|

|

Minimum & Available Margin

|

Required and available margin balance.

|

|

Profit/Loss Amount & Additional Margin Required

|

Unrealized P/L and any shortfall in margin.

|

|

Action Buttons

|

Options to Sell, Add Margin, or Convert to Delivery.

|

On clicking the Stock Code, the following additional fields are displayed:

- Settlement Number

- Convert to Delivery Quantity

- Profit / Loss %

- Squared-Off Quantity

- Exchange and Trade Date

- Cover Order Quantity

These details help track performance and manage funding or delivery decisions.

|

|

|

|

|

.

|

How long do positions remain on the MTF (Pay Later) page?

Positions remain on the MTF (Pay Later) page until the number of days specified by I-Sec.

After this period, positions are automatically squared off by the Risk Monitoring System during the EOS process.

However, positions may be squared off earlier under the following circumstances:

- The stock hits its price band (as defined by I-Sec).

- A corporate action (e.g., Bonus, Split, Rights, etc.) impacts the scrip.

|

|

|

|

|

.

|

How does a Corporate Action impact MTF positions?

Corporate actions can trigger early square-off of MTF positions to avoid price distortion or settlement issues.

I-Sec may also disable new positions in that scrip temporarily.

Example:

- You bought 100 shares of TISCO at ₹300 each under Client Mode on 11 March 2016.

- The Ex-Date for Bonus Shares is 17 March 2024.

- I-Sec may square off your position 1–2 days before the Ex-Date and disable fresh orders in the scrip until reactivation.

I-Sec retains sole discretion on whether to apply such early square-off processes depending on the corporate action’s potential price impact.

|

|

|

|

|

.

|

Can I trade in Margin at any time during the day? Can I place a Margin order at 3.25 pm.?

Yes.

You can trade in Margin (Broker and Client Square-Off Modes) during regular market hours.

- Client Mode (MTF):

Trading is available until market close (3:30 PM).

- Broker Mode (Intraday):

Trading is available until the EOS process for the day is initiated.

After EOS, you can only take or square off buy positions in Client Mode for eligible scrips.

The EOS process for Broker Mode runs for both NSE and BSE.

|

|

|

|

|

.

|

Which stocks are eligible for Margin Trading and why is the list limited?

Margin trading is currently enabled for select liquid and high-volume scrips. These stocks currently account for more than 95% of the trading volume on the exchanges.

Eligibility is determined based on:

- Liquidity

- Trading volume

- Risk parameters

You can view the latest stock list under:

Equity → Stock List → Margin Segment (NSE/BSE).

I-Sec reserves the right to add or remove scrips from the margin-eligible list at its sole discretion without prior notice.

|

|

|

|

|

.

|

How do I place a Margin Buy/Sell order?

For a Buy Order:

- Go to Equity → Transact → Place Order → Intraday Tab.

- Select Buy option.

- Choose the stock, quantity, price, and square-off mode (Broker or Client).

- Submit your order.

For a Sell Order:

- Go to Equity → Transact → Place Order → Intraday Tab.

- Select Sell option.

- Fill in the order details (quantity, price, mode) and submit.

- All other parameters (price type, product code, etc.) are identical to those in the Cash Segment.

- Ensure sufficient margin is available before placing Margin orders.

|

|

|

|

|

.

|

How do I pledge my Client-MTF positions?

As per SEBI Circular dated February 25, 2020, all funded shares under the Margin Trading Facility (MTF) must be pledged in favour of ICICI Securities Limited (I-Sec).

- The funded shares will be held in your demat account and pledged to I-Sec through a marked pledge in the Client Unpaid Securities Margin Funding Account (CUSMFA) of I-Sec.

- Effective February 25, 2025, under the Direct Payout of Securities Facility, all shares bought through MTF will be auto-pledged in favour of I-Sec on the settlement date, without the need for OTP confirmation from the client.

- All other MTF features and applicable charges remain unchanged.

|

|

|

|

|

.

|

Are there additional charges for pledging MTF shares?

Yes.

Depositories NSDL and CDSL levy additional charges for pledge-related activities on a per-ISIN, per-instruction basis, as below:

|

Type of Instruction

|

Description

|

Charges (₹ per ISIN per instruction)

|

|

Margin Trading Pledge (MTF Pledge)

|

Creation / Closure / Invocation

|

₹20 – ₹25

|

|

Auto-Pledge / Unpledge / Invocation (under MTF)

|

Applicable for shares bought under MTF

|

₹25 + GST per scrip (effective 4 April 2025)

|

|

|

|

|

|

.

|

How is delivery effected when I sell MTF-funded shares?

When you sell shares held under MTF:

- I-Sec will invoke the pledge on those shares to meet the exchange delivery obligation.

- This occurs regardless of whether the sale is initiated by you, your dealer, or through a risk-triggered square-off by I-Sec.

- This ensures proper delivery to the exchange from the pledged holdings.

|

|

|

|

|

.

|

What is an Advance Pledge?

An Advance Pledge is a future-dated pledge instruction that becomes active on the execution date, subject to:

- Sufficient share quantity being available in your demat account, and

- Required client confirmation being received.

This allows you to pre-schedule pledges for anticipated future trades.

|

|

|

|

|

.

|

Can I short sell (sell shares not held in DP)?

Yes.

You may short sell in the Margin Product, provided the position is squared off the same day before the EOS (End of Settlement) process.

You cannot carry forward a net short position to the next settlement cycle.

|

|

|

|

|

.

|

Can I place Overnight Orders in Margin Broker Square-Off Mode?

❌ No.

Buy/Sell Overnight Orders are not permitted in Margin Broker Square-Off Mode, since it is strictly intraday.

|

|

|

|

|

.

|

Can I place Overnight Orders in Margin Client Square-Off Mode?

✅ Yes.

You can place Fresh and Square-Off Buy/Sell Overnight Orders in Client Mode (MTF) using:

- Limit or VTC (Valid-Till-Cancelled) order validity.

- Fresh Orders – via the MTF (Pay Later) tab under the existing Place Order link.

- Square-Off Orders – from the MTF (Pay Later) page.

|

|

|

|

|

.

|

What happens after I place an Overnight Client Mode Order? When will it be sent to the Exchange?

Once you place an Overnight Client Mode Order:

- It will first appear in your Order Book with the status ‘Requested’.

- The order will be sent to the exchange automatically when trading opens on the next market session.

|

|

|

|

|

.

|

When does an Overnight Order change from ‘Requested’ to ‘Ordered’?

- For pre-open enabled stocks, the order becomes ‘Ordered’ in the pre-open session.

- For other stocks, it transitions to ‘Ordered’ during the regular trading session.

|

|

|

|

|

.

|

Is there any change in margin blocking for Overnight Orders?

No.

Margin blocking remains the same as that for intraday or regular MTF orders.

|

|

|

|

|

.

|

Can I place orders during the Pre-Open Session?

Yes.

You can place orders in the pre-open session for pre-open enabled stocks, but only under Margin Client Square-Off Mode.

|

|

|

|

|

.

|

Are shares blocked in my DP when I place a sell order in the Margin segment?

No.

Unlike the Cash Segment, when placing a Margin Sell Order, the securities are not blocked in your demat account at the order placement stage.

|

|

|

|

|

.

|

Can I trade in both Margin and Cash segments on the same day for the same scrip?

Yes.

You can trade in Cash and Margin on the same day, for the same scrip, on the same exchange or across exchanges, irrespective of the Margin square-off mode.

|

|

|

|

|

.

|

Can I convert a pending Margin order into a Cash order?

No.

Only executed Margin positions can be converted to delivery (Cash Segment).

For pending Margin orders, you must cancel the Margin order and place a fresh Cash order.

|

|

|

|

|

.

|

Can I take a Margin position in Client Mode if I have unsettled positions in Cash?

Yes.

You can take a Margin position (Client Mode) even if you have unsettled Cash Segment positions.

Such unsettled positions can be viewed under the Securities Projection page in the Equity section.

|

|

|

|

|

.

|

Can I choose different square-off modes for the same scrip on different days?

Yes.

You may choose different square-off modes for the same scrip on different trading days.

However, on the same day, you cannot have orders/positions in the same scrip on one exchange with different modes.

|

|

|

|

|

.

|

If I hold a position in MTF (Pay Later), can I place Cash orders in the same scrip?

Yes.

You may place Cash Buy or Sell orders in the same scrip even if you have an open MTF (Pay Later) position, on the same or different exchange.

Alternatively, you can:

- Convert to Delivery from the Pending for Delivery page, or

- Place new Margin orders in Client or Broker Mode for the same scrip.

|

|

|

|

|

.

|

I squared off my position in Pending for Delivery. Can I still place Cash orders in that scrip today?

Yes.

Once you have fully or partially squared off a position in the Pending for Delivery page, you can:

- Place Cash Sell orders in the same scrip, and/or

- Place new Margin orders in the same scrip on the same day, on the same or different exchange.

|

|

|

|

|

.

|

Can I place a Margin order in Client Mode if I’ve pledged the same scrip as margin?

Yes.

You may place Margin orders (Client Mode) even if the same scrip has been pledged as margin, and vice versa.

|

|

|

|

|

.

|

Is the facility to buy in Client Square-Off Mode available for all scrips?

No.

The Client Square-Off (MTF) Buy facility is available only for select eligible securities as determined by I-Sec from time to time.

|

|

|

|

|

.

|

How can I know which securities allow the Client Square-Off mode?

To check the list of securities where the Client Square-Off (MTF) facility is available:

Path:

Login to www.ICICI Direct.com → Stock > Services > Stock List

- Under the “Client Square-Off Mode Enabled” column, look for the Intraday/Pay Later - MTF column.

- If the value is displayed as ‘Y’, the facility is available for that scrip.

- If the value is ‘N’, Client Square-Off is not available for that scrip.

|

|

|

|

|

.

|

How can I differentiate between Margin and Cash orders in the Order Book?

In your Order Book, you can distinguish order types by their display format:

|

Order Type

|

Segment Label

|

Background Color

|

|

Margin Order

|

“Intraday”

|

Yellow

|

|

Cash Order

|

“Delivery”

|

White

|

|

|

|

|

|

.

|

How can I view my open positions in Margin?

- To view intraday open positions created during the current trading day:

Go to Open Positions > Intraday.

You’ll see details like:

- Stock name

- Buy/Sell direction

- Open quantity

- Cover order quantity

- Weighted average buy/sell price

- Current market price

- Mark-to-market (MTM) profit/loss

- Total margin blocked

- To view Margin positions taken in earlier settlements (under MTF):

Visit the MTF (Pay Later) page under the Equity section of your ICICI Direct account.

|

|

|

|

|

.

|

How can I change the square-off mode of my open Margin positions?

You can change the square-off mode directly from your Margin Positions page.

Steps:

- Go to Margin Positions.

- Locate the position and click on the “Change Mode” link.

- The Square-Off Mode column will show your current mode (e.g., “Broker” or “Client”).

- On clicking Submit, you can switch to the other mode.

Example:

If your current mode is Broker, selecting Submit changes it to Client.

Note:

You can change the mode anytime before the End of Settlement (EOS) process is run for the day.

|

|

|

|

|

.

|

How many times can I change the square-off mode?

You can change the square-off mode as many numbers of times as you want before the EOS process runs.

After EOS, the square-off mode for Margin positions cannot be changed.

|

|

|

|

|

.

|

Why am I unable to Convert to Delivery (CTD) for certain Margin or MTF positions?

Due to regulatory norms on trade netting and settlement, ICICI Direct has implemented restrictions on certain securities and actions to remain compliant.

To view the full list of restricted actions and scrips, visit:

[Click here] (available on the ICICI Direct platform).

|

|

|

|

|

.

|

How much margin would be blocked when I place a Margin order?

- Margin is blocked at the applicable margin percentage of the order value.

- For market orders, the system uses the last traded price (LTP) to calculate the order value for margin blocking.

- Once the order is executed, the margin is adjusted to reflect the actual execution price.

For more details on the margin percentage login to your account and visit the Stock List option in Equity section of the Trading page.

|

|

|

|

|

.

|

Is the margin percentage the same for all securities?

No.

Margin percentages vary by security and may change between settlements based on:

- Liquidity of the stock

- Volatility

- Overall market conditions

For detailed margin rates, refer to the Stock List in Equity Section under the Equity Trading page on www.ICICI Direct.com.

|

|

|

|

|

.

|

Is margin blocked on all Margin orders?

No. Margin is blocked only for fresh Margin orders (orders that create a new position).

If the order is a cover order (used to square off an existing position), no additional margin is blocked.

Example 1:

You have a buy position of 100 shares of Reliance in Margin.

If you now place a sell order for 100 shares, it’s treated as a cover order, and no new margin is blocked.

Example 2:

If you sell 150 shares, then the extra 50 shares (beyond your open position) are considered a fresh order, and margin will be blocked for those 50 shares.

Important:

Cover orders are recognized only against executed trades, not against pending/unexecuted orders.

So, if your buy order for TISCO (100 shares) is still pending and you place a sell order for 100 shares, the sell order will not be treated as a cover order—it will attract fresh margin.

|

|

|

|

|

.

|

Is there any impact on limits when Margin orders are executed?

Yes, executing a Margin order impacts your trading limits:

- For new positions:

Margin is adjusted based on the actual execution price versus the price used for blocking.

Any difference results in limit adjustment.

- For cover (square-off) orders:

Margin blocked on the open position (proportionate to squared-off quantity) is released, and profit or loss from the transaction is accounted for.

- Released margin and profit are adjusted in your available limits.

- Profits remain withheld until end of day.

You can view detailed limit utilization under:

Equity Trading Page → Limits

|

|

|

|

|

.

|

When is margin released on Margin positions?

Margin blocked on a position is released immediately when:

- A Margin Sell position is closed (either squared off or converted to delivery), or

- A Margin Buy position is closed by squaring off.

The proportionate margin on the squared-off quantity is released and added back to your available trading limits.

|

|

|

|

|

.

|

What is meant by ‘squaring off a position’? What is a cover order?

Squaring off a position means closing an existing margin position.

- If you have bought shares, squaring off means selling those shares.

- If you have sold shares short, squaring off means buying them back.

You can place a square-off order by clicking on the ‘Square Off’ link available against your margin open positions.

It is recommended to place such orders through the ‘Intraday’ or ‘MTF (Pay Later)’ page to:

- Avoid duplicate orders, and

- Ensure that you don’t accidentally create fresh positions.

Example:

If you have a margin Buy position of 100 Reliance shares, placing a Sell order for 100 Reliance shares will square off your position.

The order placed to close this position is called a Cover Order.

|

|

|

|

|

.

|

How do I place a square-off order in Margin to close my open positions?

You can place square-off orders as follows:

- For intraday positions created during the day:

Use the ‘Square Off’ hyperlink on the Intraday page or the standard Buy/Sell order page.

- For MTF positions (carried from earlier settlements):

Use the ‘Square Off’ hyperlink on the MTF (Pay Later) page.

|

|

|

|

|

.

|

How is profit or loss recognized on execution of a square-off (cover) order?

Profit or loss is calculated by comparing:

- The execution price of the square-off order, and

- The weighted average price at which the position was created.

Example:

You have a Buy position of 100 Reliance shares built through:

- 50 shares @ ₹110 = ₹5,500

- 50 shares @ ₹90 = ₹4,500

Weighted Average Price = (₹5,500 + ₹4,500) / 100 = ₹100

If you sell 60 shares @ ₹105,

Profit = 60 × (105 - 100) = ₹300

|

|

|

|

|

.

|

Can I reduce the margin against my position if I have profit or excess margin available?

No.

Margin cannot be manually reduced by you.

Margin is released only in the following cases:

- When you cancel an unexecuted margin order, or

- When you close (square off) a margin position.

|

|

|

|

|

.

|

Where can I see the quantity squared off for earlier settlement positions?

To view squared-off quantities for positions taken in earlier settlements:

- Go to the MTF (Pay Later) page.

- Click on the Stock Code.

- A detailed view will appear showing the squared-off quantity and related details.

|

|

|

|

|

.

|

Is it compulsory to square off all margin positions within the settlement?

Yes.

All open margin positions (net of any converted to delivery) must be squared off within the same settlement.

|

|

|

|

|

.

|

What happens if margin positions remain open at the end of settlement?

If any margin position remains open after settlement:

- ICICI Securities (I-Sec) will attempt to square off such positions on a best-effort basis.

- However, it is your responsibility to close all open positions.

If positions remain open, you will be required to arrange funds or securities to settle them.

You will be fully liable for any resulting auction, penalty, or interest charges.

|

|

|

|

|

.

|

What happens if MTF positions are not squared off by me in the same settlement?

MTF positions not squared off during the same day will:

- Remain open, and

- Be shifted to the MTF (Pay Later) page.

You must either:

- Convert to Delivery (CTD) by clicking ‘Convert to Delivery’ on the Pending for Delivery page, or

- Square off using the ‘Square Off’ link on the same page.

If not acted upon within the stipulated time, I-Sec may automatically square off these positions after a defined number of trading days, without prior notice and at its sole discretion.

|

|

|

|

|

.

|

What is End of Settlement (EOS)?

End of Settlement (EOS) is a daily process run by ICICI Securities to:

- Identify open margin positions that have not been squared off, and

- Close them automatically on a best-effort basis.

Two types of EOS processes are run:

1. EOS for Current Settlement

In this process, I-Sec cancels or squares off:

- All unexecuted Broker Square-Off mode buy/sell margin orders, and

- All open positions in the Broker mode for the current settlement.

Action Summary:

|

S.No.

|

Open Position

|

Pending Orders

|

Action Taken

|

|

1

|

Broker Mode Sell Position

|

Client Mode Buy

|

Cancel

|

| |

|

Broker Mode Buy

|

Cancel

|

| |

|

Broker Mode Sell

|

Cancel

|

|

2

|

Broker Mode Buy Position

|

Broker Mode Sell

|

Cancel

|

| |

|

Broker Mode Buy

|

Cancel

|

|

3

|

Client Mode Buy (T Day)

|

Client Mode Buy

|

Not Cancelled

|

| |

|

Broker Mode Sell

|

Cancel

|

|

4

|

No Open Position

|

Broker Mode Buy / Sell

|

Cancel

|

| |

|

Client Mode Buy

|

Not Cancelled

|

2. EOS for Earlier Settlements

In this process, I-Sec will:

- Cancel all unexecuted square-off orders for that earlier settlement, and

- Square off buy positions from earlier settlements (visible on the Pending for Delivery page) that are marked under Client Square-Off Mode.

The stipulated time for the EOS process for earlier settlements is displayed daily on the Pending for Delivery page.

If the EOS process cannot be run at the scheduled time for any reason, I-Sec may execute it on the next trading day at its discretion.

|

|

.

|

Will all open positions be squared off when the End of Settlement (EOS) process is run?

- All open Sell positions will be squared off by ICICI Securities (I-Sec) on a best-effort basis during the EOS process.

- For Buy positions, only those marked under ‘Broker Square Off’ mode will be squared off by I-Sec.

- Client Square Off (MTF) Buy positions will not be squared off on the trade day (T Day).

- The responsibility to close such positions lies with you.

- However, if the required funds are not brought in within the stipulated time, I-Sec will square off these positions in the EOS run for that earlier settlement.

|

|

|

|

|

.

|

Will the EOS process cancel my pending Sell orders if I have an open Client mode position on T Day?

The current settlement EOS process will cancel your pending Sell orders against open Client mode Buy positions only if the total Sell order quantity exceeds your open Buy position.

Examples:

|

Scenario

|

Open Buy Qty

|

Pending Sell Orders (Qty)

|

EOS Action

|

|

1

|

100

|

60 + 40 + 30 = 130

|

All Sell orders cancelled (Sell qty > Buy qty)

|

|

2

|

100

|

60 + 40 = 100

|

No cancellation (Sell qty = Buy qty)

|

|

3

|

100

|

10 + 20 + 15 = 45

|

No cancellation (Sell qty < Buy qty)

|

Note:

Open Buy positions under Client Square Off mode are not squared off during the EOS process for the current settlement.

|

|

|

|

|

.

|

Will the EOS process cancel my pending Buy orders if I have a Sell position on T Day?

Yes.

If you have an open Sell position on T Day, the current settlement EOS process will:

- Cancel all pending Buy orders (in both Client and Broker modes), and

- Square off the open Sell position on a best-effort basis.

|

|

|

|

|

.

|

Can Margin Sell orders be modified after the EOS process?

No.

Once the EOS process is run, Margin Sell orders cannot be modified.

|

|

|

|

|

.

|

Is there any client-wise stock-wise position limit for Client Mode (MTF) positions?

Yes.

I-Sec has defined client-wise stock-wise limits for Margin Trading Facility (MTF) positions.

- If these limits are breached, I-Sec reserves the right to square off positions at its discretion.

- Limits are defined separately for each exchange (NSE & BSE).

Example:

If the client-wise limit for ITC is ₹40 crore and your total position reaches ₹41 crore, I-Sec may square off part of your position to bring it within the limit.

|

|

|

|

|

.

|

Is there an overall stock limit for Client Mode positions?

Yes.

There are overall stock-level limits for Client Mode (MTF) positions across clients.

If this overall limit is breached, I-Sec may square off positions at its discretion to maintain exposure limits.

|

|

|

|

|

.

|

Is there any single client exposure limits for Margin Trading Facility as per SEBI

guidelines?

Yes, there is single client exposure limits for Margin Trading Facility as per SEBI

guidelines and if this limit is breached then I-Sec reserves the right to square

off the positions at its discretion.

Example :

Suppose the Max allowable client wise exposure limit is 30 Cr. and Client positions

is 32 Cr which exceeds the limit of 30 Cr. then the position of customer may get

squared off by I-Sec at its discretion to bring client positions within the above

limit.

|

|

|

|

|

.

|

Is there any Max allowable exposure limits for Margin Trading Facility as per SEBI

guidelines?

Yes, SEBI has given Max allowable exposure limits to Trading Members for Margin

Trading Facility and if this limit is breached then I-Sec reserves the right to

square off the positions at its discretion.

|

|

|

|

|

.

|

Where can I declare Promoter/Promoter Group status?

You can declare Promoter/Promoter Group status from 'Update Promoter Status' link

available on below mentioned pages :

- 'Pending for Delivery' page

- 'Block/Create Limit' and 'Blocked Securities' pages under 'Shares as Margin'

|

|

.

|

Why declaration of stocks in which I am part of Promoter/Promoter Group is required?

You are required to declare the stocks in which you are part of Promoter/Promoter

Group as per SEBI guidelines as this declaration will be used for reporting to exchanges

if you have taken MTF position in such stocks or given them as collateral. Also,

you can add / delete your promoter status by addition / deletion of record through

'Update Promoter Status' link.

Please note for all other not declared stocks, you will be considered as Non Promoter

for the purpose of reporting your transactions to exchanges under the Margin Trading

product as per SEBI guidelines.

|

|

|

|

|

.

|

Will my Margin Trading Facility positions may get squared off if the Stock in which

I have taken position moves out from the eligible list of Stocks?

Yes, your Margin Trading Facility position may get squared off by I-Sec at its discretion

in case the Stock in which you have taken the position moves out from the eligible

list of Stocks.

|

|

|

|

|

.

|

What is meant by 'Convert to Delivery' ?

'Convert to Delivery' (CTD) is an option through which you can convert a Margin

open position into a Cash position and receive or give delivery of shares thereof.

You can do CTD of your Broker mode or Client mode position from Open position page