Fusion Micro Finance Ltd. was originally incorporated as `Ambience Fincap Private Limited` on September 5, 1994 at New Delhi, India as a Private Limited Company under the Companies Act, 1956. Subsequently, name of the Company changed to `Fusion Micro Finance Private Limited` and a fresh Certificate of Incorporation, dated April 19, 2010 was issued by the RoC to describe the business of the Company, post which the RBI granted a certificate of registration dated May 19, 2010 reflecting the change of name. The name of Company was further changed to Fusion Micro Finance Limited upon conversion to a Public Limited Company on July 20, 2021, post which a fresh Certificate of Registration as an NBFC (not accepting public deposits) dated October 1, 2021, was issued by the RBI reflecting the change in name of the Company.

The Company is a microfinance company providing financial services to underserved women across India in order to facilitate their access to greater economic opportunities. It had the fourth fastest gross loan portfolio CAGR of 53.89% between the financial years 2017 and 2021 among the 10 largest NBFC-MFIs in India, and was one of the youngest companies among top NBFC-MFIs in India in terms of AUM as of June 30,2022, according to CRISIL. As of June 30, 2022 and March 31, 2022, 2021 and 2020, the total AUM was Rs. 73,890.23 million, Rs. 67,859.71 million, Rs. 46,378.39 million and Rs. 36,065.24 million, respectively. As of June 30, 2022, the Company had 2.90 million active borrowers which were served by nearly 966 branches and 9,262 permanent employees spread across 377 districts in 19 states and union territories in India.

The Company is primarily engaged in micro finance lending activities, providing financial services to poor women in India who are organized as Joint Liability Group(JLGs). It provides small value collateral free loans. Apart from micro finance lending, it also has lending to MSME enterprises. It uses its distribution channel to provide other financial products and services to the members primarily relate to providing of loans to the members for the purchase of certain productivity enhancing products such as mobile handsets, bicycle.

The key product offerings are income-generating loans that provide capital for women entrepreneurs in rural areas to fund businesses operating in agriculture-allied and agriculture, manufacturing and production, trade and retail, and services sectors. In addition, it offer existing customers cross-sell loans that are utilized for livelihood and productivity enhancing purposes as well as MSME loans to eligible enterprises.

It is further premised on the fact that if such individuals are given access to credit, they will be able to identify new opportunities and/or grow existing income-generating activities such as running local retail shops, providing tailoring and other assorted trades and services, raising livestock, cottage production such as pottery, basket weaving and mat making, land and tree leasing, among others. It lend to women in low income households, even if loan proceeds are used in the household business that is run by the family, including the husband.

The Company came out with a public issue during November, 2022 by raising Rs. 1103.99 crores through fresh issue amounting to Rs. 600 crores and offer for sale amounting to Rs. 503.99 crores.

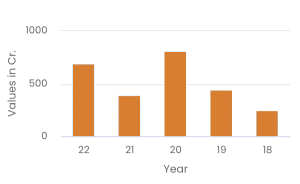

Fusion Micro Finance share price as on 17 Jul 2024 is Rs. 442.65. Over the past 6 months, the Fusion Micro Finance share price has decreased by 26.73% and in the last one year, it has decreased by 27.05%. The 52-week low for Fusion Micro Finance share price was Rs. 416.2 and 52-week high was Rs. 691.

Top Mutual Funds

Top Mutual Funds