Industrial Machinery company GE T&D India announced Q4FY24 & FY24 results:

Q4FY24 Financial Highlights:

- Revenue was Rs 9.1 billion, against Rs 7.0 billion in Q4FY23, up by 30.0%

- EBITDA was at Rs 1,167 million (12.8%), against Rs 316 million (4.5%) in Q4FY23

- Profit After Tax was at Rs 663 million (7.3%), against loss of Rs 154 million (-2.2%) in Q4FY23

- Order bookings were Rs 13.3 billion compared to Rs 8.7 billion in Q4FY23, up by 53%

FY24 Financial Highlights:

- Revenue was Rs 31.7 billion, against Rs 27.7 billion in FY23, up 14% YoY

- EBITDA was at Rs 3,415 million (10.8%), against Rs 1,355 million (4.9%) in FY23

- Profit After Tax was at Rs 1,811 million (5.7%), against Rs (15) million (-0.1%) in FY23

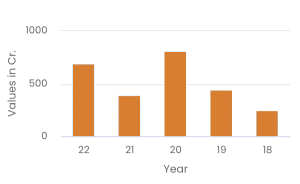

- Order bookings were Rs 57.9 billion compared to Rs 27.4 billion in FY23, up 112% YoY

- The board of directors of the company have recommended a dividend of Rs 2/- per equity share for the financial year 2023-24 subject to shareholder’s approval.

Sandeep Zanzaria, Managing Director & CEO of GE T&D India Limited, said, “In FY24, GE T&D India Ltd. achieved a strong turnaround, delivering excellent results on all fronts. We saw a surge in order booking and our backlog improved along with steady growth in revenues and substantial growth in profits & cash. The company consolidated its position on free cashflow, and the Board has recommended a dividend of Rs 2/- to our shareholders after a gap of 5 years. India is poised to witness a very fast growth in electricity demand among major economies over the next decade. With ongoing investments in grid modernization, capacity expansion, and the integration of technologies, the outlook for the country’s transmission segment is promising.”

Top Mutual Funds

Top Mutual Funds