IEX trades 8760 MUs in February

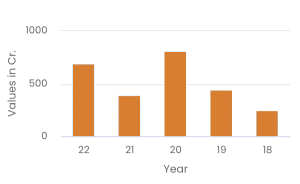

Indian Energy Exchange (IEX) is the premier electricity exchange in India, which facilitates trading of electricity. IEX commands a market share of ~95% in the power exchange market The company has a debt free balance sheet with cash & investments to the tune of ~ ₹ 700 crore

Invest

Invest